2023 LGBTQ Real Estate Report

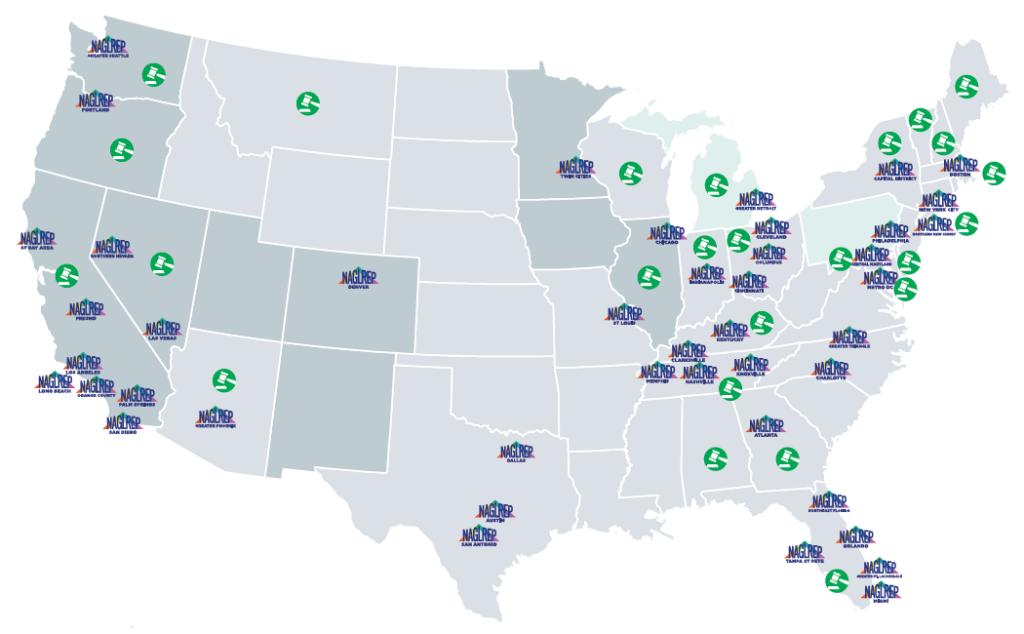

NAGLREP, the nation’s first and largest LGBTQ Real Estate trade organization, has grown to 3,000+ members and 44 local chapters around the nation.

The NAGLREP Fifth annual LGBTQ Real Estate Report sheds light on the experiences, challenges, and achievements of the LGBTQ community in residential housing. By examining homeownership rates, rental trends, family formation, housing discrimination, and generational statistics the report provides an overview of the progress made and highlights the areas that require attention. Drawing on data from reputable sources such as the National Association of Gay and Lesbian Real Estate Professionals (NAGLREP), Human Rights Campaign (HRC), Gay & Lesbian Alliance Against Defamation (GLAAD), and National LGBT Chamber of Commerce (NGLCC), we present a comprehensive analysis of the LGBTQ community’s journey toward achieving equal rights in the real estate sector.

By addressing discrimination, supporting homeownership, and advocating for inclusive policies, real estate agents play a pivotal role in fostering equality for all individuals, regardless of their sexual orientation or gender identity.

NAGLREP combines business and advocacy for equality to advance sustainable homeownership and financial stability in the LGBTQ community. NAGLREP is working with local, state and federal leadership, along with local and state Realtor® associations, and the National Association of Realtors® to eradicate housing discrimination based on sexual orientation and gender identity. Our vibrant community of LGBTQ and allied real estate professionals continuously engages in education and networking opportunities to develop and enhance their business relationships while helping the real estate industry further its connections to the LGBT community.

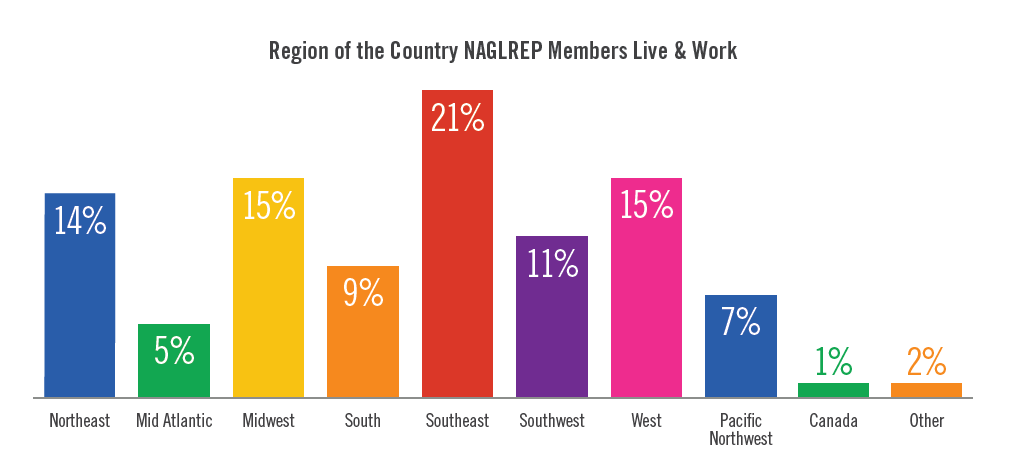

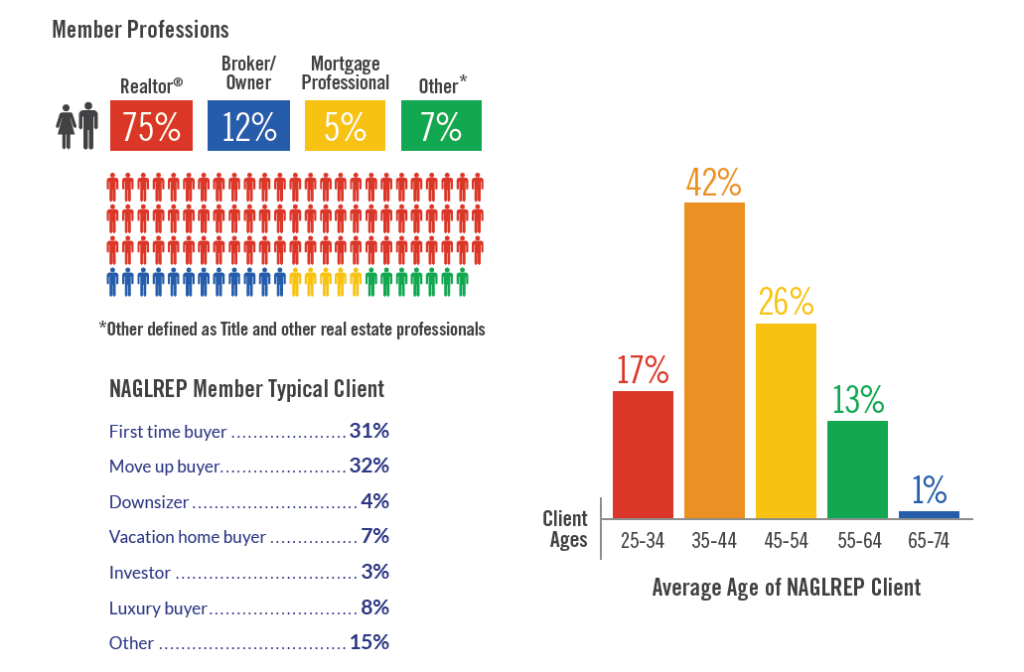

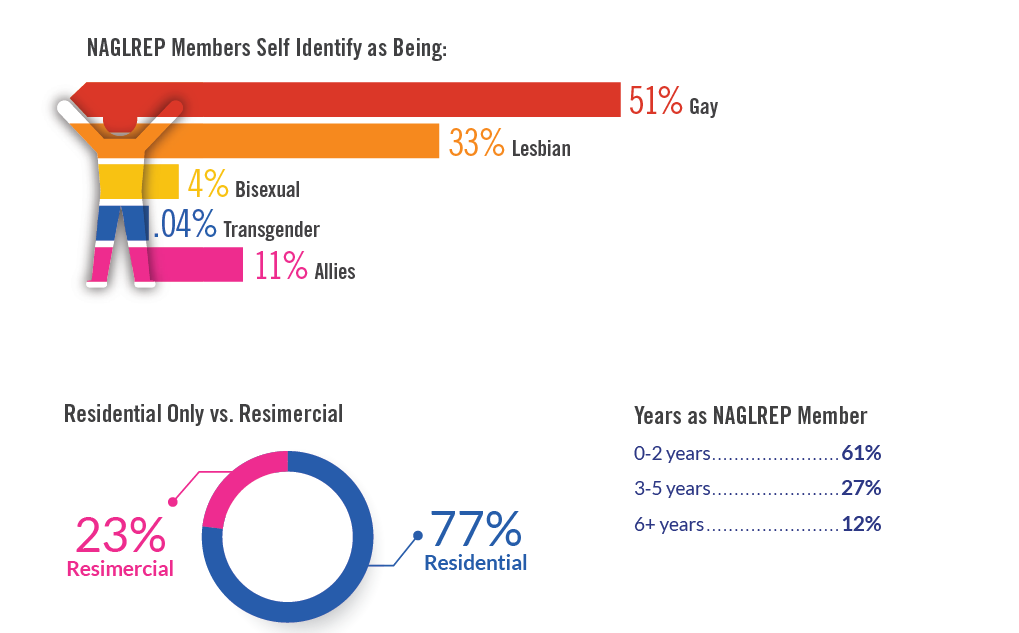

The 2023-24 NAGLREP LGBTQ Real Estate Report was fielded via Survey Monkey in February and March with a pulse survey of 300 NAGLREP members responding (10% of the NAGLREP membership).

The Power and Challenges of LGBTQ Housing and Economic Equality

The LGBTQ community has made significant strides towards equality and inclusion in recent years. However, there are still notable challenges, particularly in the areas of housing and economic disparities. This section of the report will explore statistics from prominent LGBTQ organizations, including the National Association of Gay and Lesbian Real Estate Professionals (NAGLREP), the Human Rights Campaign (HRC), Gay & Lesbian Alliance Against Defamation (GLAAD), and the National LGBT Chamber of Commerce (NGLCC), to shed light on the current landscape. Additionally, we will delve into the annual buying power of the LGBTQ community, highlighting its economic significance.

LGBTQ Housing Statistics

According to NAGLREP’s 2021 Homeownership Survey, LGBTQ individuals face unique challenges in the housing market. The survey found that LGBTQ homeownership rate is 49% vs non LGBTQ homeownership rate of 65%. The survey also found that 46% of LGBTQ renters fear discrimination in their housing search, leading to anxiety and hesitation. Furthermore, the survey highlighted that only 49% of LGBTQ renters felt comfortable expressing their identity openly within their rental community.

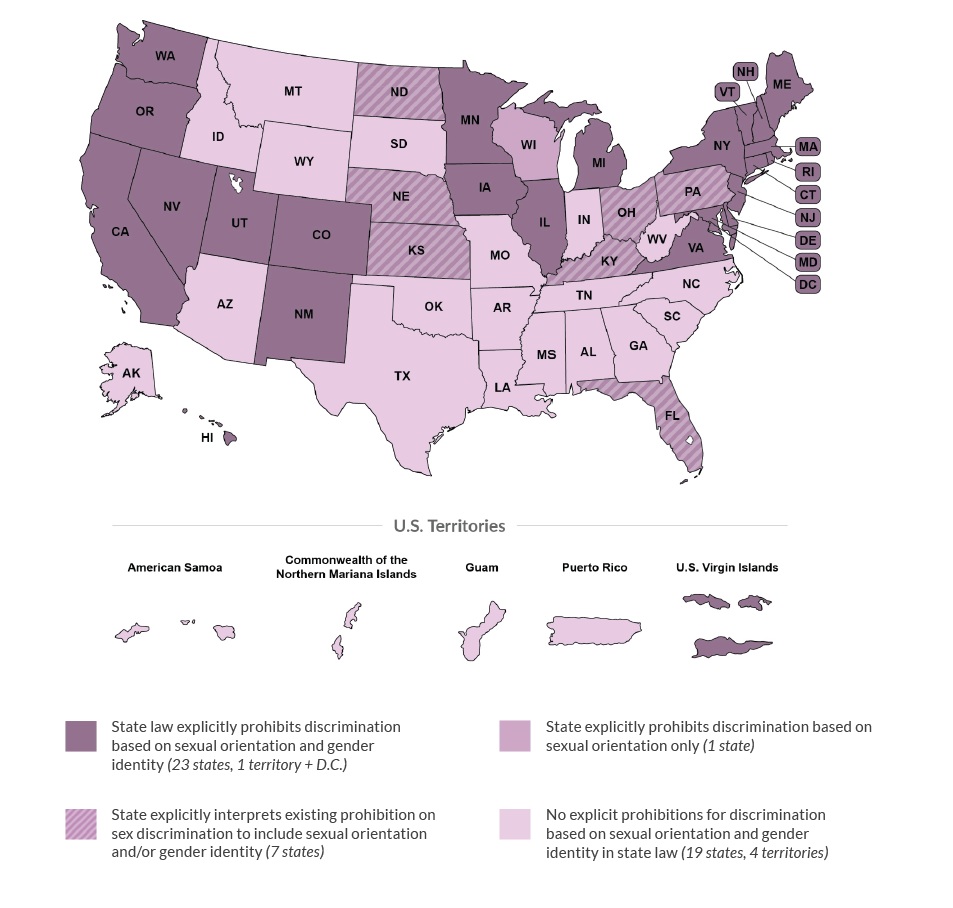

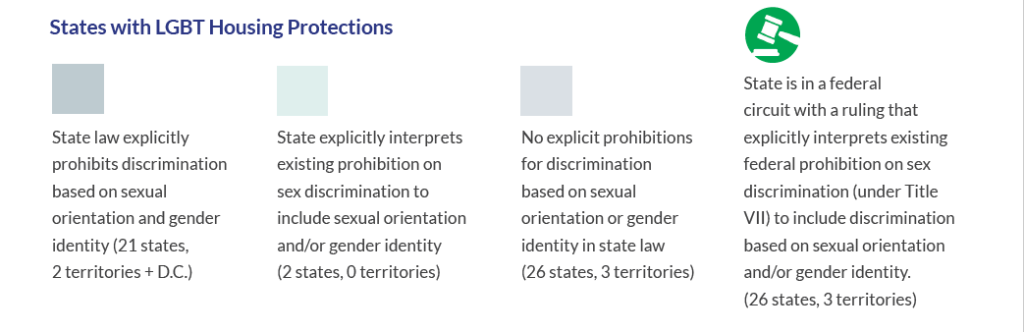

The HRC’s “State Maps of Laws and Policies” project reveals the varied legal protections for LGBTQ individuals across the United States. As of 2023, 23 states and the District of Columbia have laws that explicitly prohibit housing discrimination based on sexual orientation and gender identity, while the remaining states have varying degrees of protection or none at all. These disparities can create hurdles for LGBTQ individuals seeking safe and inclusive housing.

GLAAD’s annual “Accelerating Acceptance” report highlights the importance of LGBTQ-inclusive policies in fostering a sense of belonging. It found that 80% of non-LGBTQ Americans believe that LGBTQ individuals should have equal rights when it comes to housing and employment. However, there is still work to be done to ensure these beliefs translate into concrete protections for LGBTQ individuals and families.

LGBTQ Economic Statistics

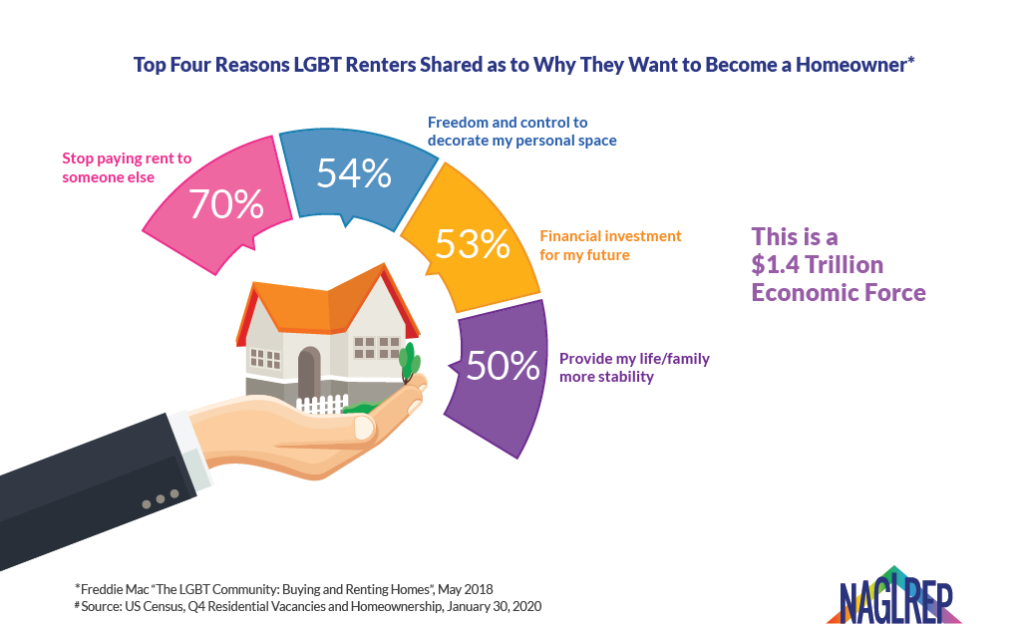

The economic power of the LGBTQ community is significant and continues to grow. According to the 2021 US government census data, the LGBTQ+ community is the fastest growing minority segment in the U.S., with close to $1.4 Trillion annual buying power, reflecting a substantial economic force. This figure demonstrates the potential for economic growth and development within the community.

The National LGBT Chamber of Commerce (NGLCC) “Americas LGBT Economy” report highlights the increasing number of LGBTQ-owned businesses, estimating that there are over 1.4 million LGBTQ-owned businesses in the United States. These businesses generate approximately $1.7 trillion in annual revenue, creating job opportunities and contributing to the overall economy.

Despite these positive indicators, disparities persist within the LGBTQ economic landscape. A study by the Williams Institute at the UCLA School of Law found that LGBTQ individuals are more likely to live in poverty compared to their heterosexual counterparts. The study revealed that LGBTQ adults experienced poverty rates between 16% and 27%, compared to a national average of 13%. These disparities are even more pronounced for transgender individuals and people of color within the LGBTQ community.

The COVID-19 pandemic has also disproportionately affected LGBTQ individuals economically. A survey conducted by the HRC Foundation reported that 30% of LGBTQ respondents experienced a reduction in work hours, while 14% lost their jobs entirely due to the pandemic. This disruption highlights the vulnerability of the LGBTQ community to economic shocks and the need for targeted support.

While progress has been made in securing legal protections and recognition for LGBTQ individuals, housing discrimination and economic disparities remain significant challenges. Organizations such as NAGLREP, HRC, GLAAD, and NGLCC play crucial roles in advocating for LGBTQ rights and fostering inclusivity.

Efforts to combat housing discrimination and promote LGBTQ-inclusive policies are essential to ensure safe and welcoming living environments for all. Similarly, addressing economic disparities requires targeted policies and support, recognizing the significant economic power and potential of the LGBTQ community.

Discrimination is Playing a Role

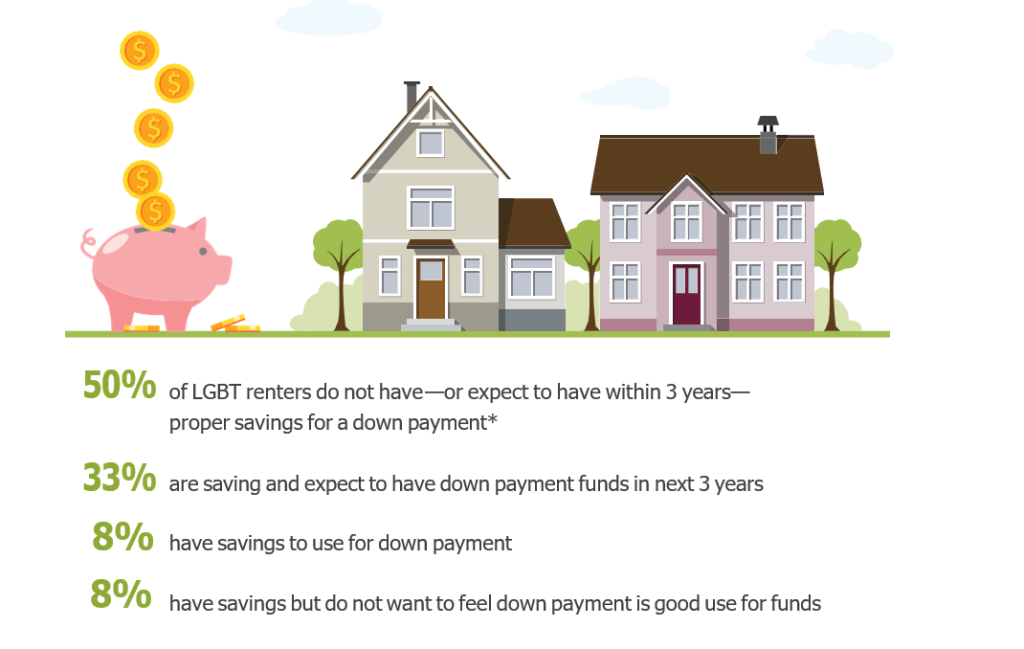

The LGBT Real Estate Report showcases how similar the LGBT community is to all other groups in their desire to own a home. But while the typical financial challenges and desire to reach life milestones prior to purchasing exist, there is no doubt that discrimination, and the fear of discrimination, plays an oversized role in where the LGBT community live and if they rent or own.

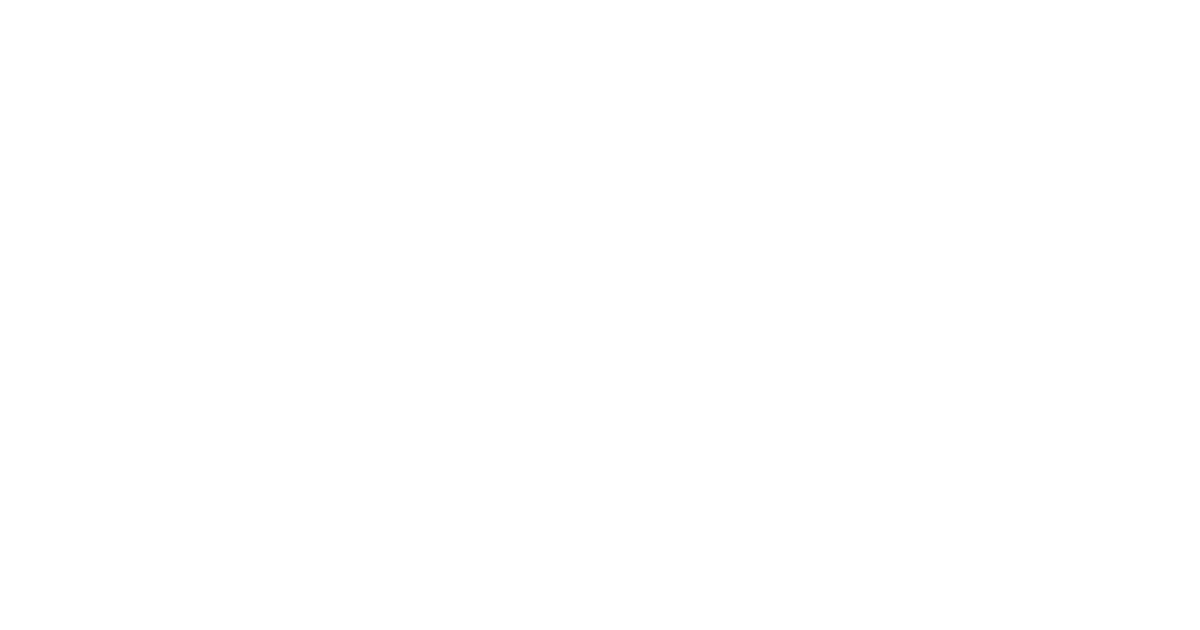

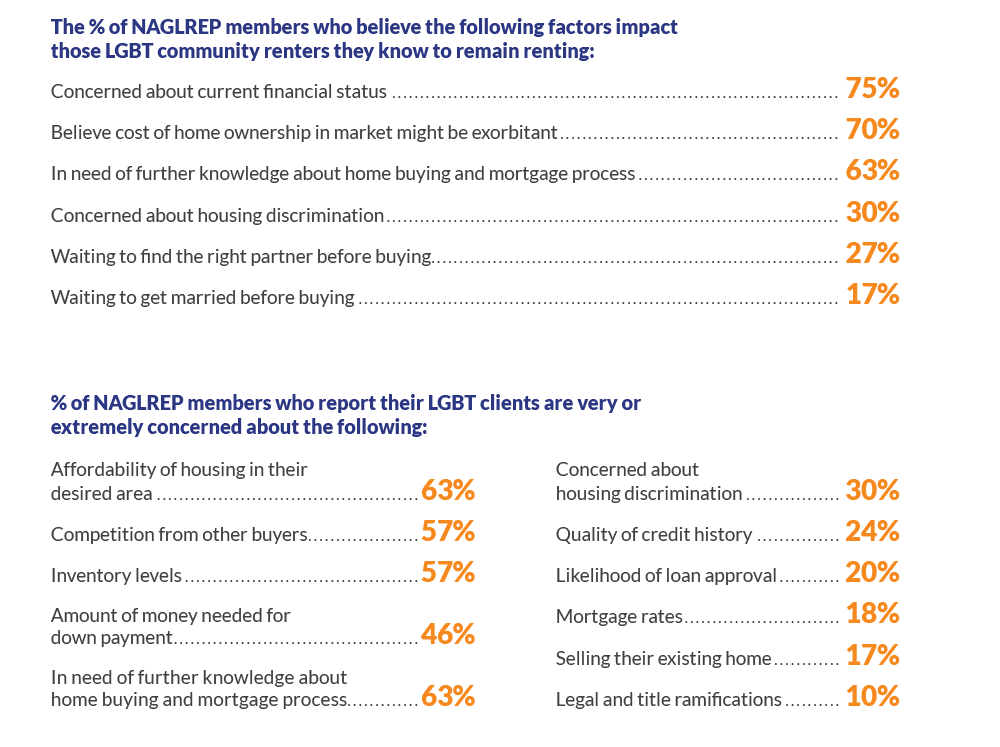

30% of NAGLREP members believe a concern about housing discrimination keeps LGBT renters they know renting. Outside of that fear, the other reasons are more traditional. NAGLREP members also cited a variety of concerns the community faces that are keeping LGBT homeownership rates to just 49% vs. 65% nationally.

Discrimination: Real or Perceived?

While LGBT renters fear discrimination in their future home buying process, the actual number of instances and reported cases are much less. While 46% of LGBT renters fear discrimination in the buying process, only 13% of LGBT homeowners actually experienced discrimination when buying. Only 4% reported discrimination.*

Still, 23% of NAGLREP members believe a sizeable number of clients will experience more housing discrimination than in past years (was 20% in 2019).

Discrimination and Legal Barriers

Despite advancements in LGBTQ rights, discrimination can still occur in the housing market. Some studies have found evidence of LGBTQ individuals facing discriminatory practices when attempting to purchase a home or secure a mortgage. Additionally, legal barriers such as limited legal protections or the absence of anti-discrimination laws in certain jurisdictions can further hinder LGBTQ homeownership rates. There are still no federal protections for the LGBTQ community as it pertains to the Federal Fair Housing Act, and 19 states and 4 U.S. Territories still allow LGBTQ discrimination in housing.

Progress and Challenges: LGBTQ Family Formation, Housing Discrimination, Suburban Migration, and Inclusive Schools

The LGBTQ+ community has made significant strides towards achieving equality in recent years. This section of the report examines crucial statistics related to LGBTQ+ family formation, including marriage and children. Additionally, it delves into the persisting issue of housing discrimination faced by the community. It further explores the trend of LGBTQ+ individuals and families moving to the suburbs. Lastly, the report discusses the importance of inclusive schools that welcome LGBTQ+ children. By highlighting these statistics, we gain insight into both the progress made and the challenges that still remain.

LGBTQ+ Family Formation: Marriage and Children

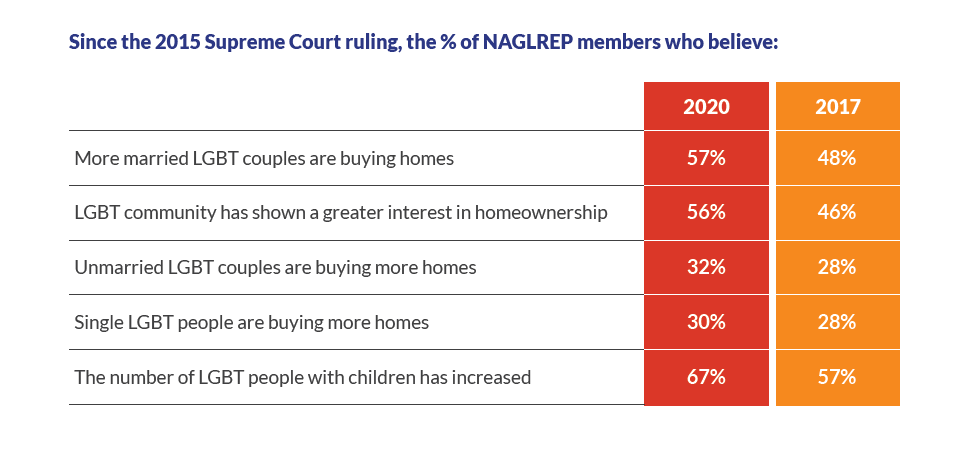

Family formation has always been a leading indicator for housing growth. As a family has children, it’s needs for housing change including the need to move to a larger home. On June 26, 2015, the U.S. Supreme Court struck down all state bans on same-sex marriage, legalized same sex marriage in all fifty states, and required states to honor out-of-state same-sex marriage licenses in the case Obergefell v. Hodges. The U.S. Supreme Court ruling has had a transformative impact on LGBTQ+ family formation. According to the Williams Institute, as of 2021, an estimated 61% of same-sex couples in the United States are married. This represents a significant increase since the 2015 landmark Supreme Court ruling Obergefell v. Hodges. Moreover, 19% of same-sex couples are raising children, with approximately 3 million LGBTQ+ individuals parenting children under the age of 18.

The Family Equality Council “LGBTQ Family Building Survey” of 2019 provides insight into how many LGBTQ people are interested in becoming parents, and how they are planning to do so. Most significantly, the data reveals dramatic differences in expectations around family building between LGBTQ Millennials and older generations of LGBTQ people.

Key findings include:

- 77% of LGBTQ “Millennials” (aged 18-35) are either already parents or are considering having children, a 44% increase over their elders

- 63% of LGBTQ Millennials (aged 18-35) are considering expanding their families, either becoming parents for the first time, or by having more children

- 48% of LGBTQ Millennials are actively planning to grow their families, compared to 55% of non-LGBTQ Millennials, a gap that has narrowed significantly in comparison to older generations

- 63% of LGBTQ people planning families expect to use assisted reproductive technology, foster care, or adoption to become parents, a significant shift away from older generations of LGBTQ parents for whom the majority of children were conceived through intercourse.

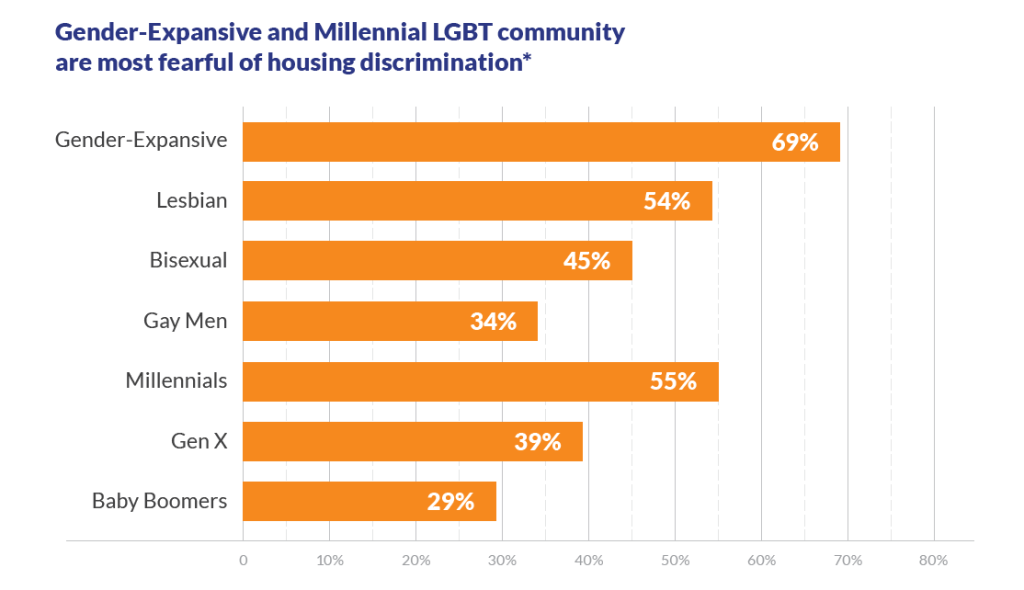

Housing Discrimination and LGBTQ+ Individuals and Families

Unfortunately, discrimination in housing remains a significant concern for the LGBTQ+ community. The National Association of Gay and Lesbian Real Estate Professionals (NAGLREP) reports that same-sex couples experience housing discrimination in 44% of inquiries when looking for rental housing. Moreover, transgender individuals face even higher rates of housing discrimination, with approximately 1 in 5 experiencing homelessness at some point in their lives. Efforts are underway to address these issues through legislation and education to promote fair housing practices and protect the rights of LGBTQ+ individuals. The proposed but not yet passed Equality Act would amend the Federal Fair Housing Law to include protections based on sexual orientation and gender identity.

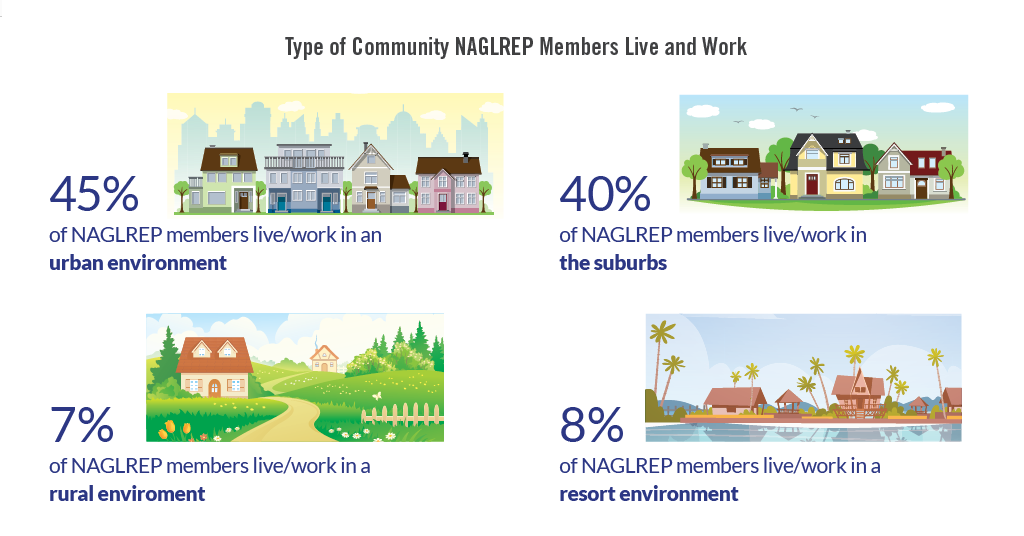

Suburban Migration of the LGBTQ+ Community

A noticeable trend in recent years is the migration of LGBTQ+ individuals and families from urban centers to the suburbs. This shift can be attributed to factors such as family formation, the desire for more space, better schools, and a sense of community. According to a study conducted by the Urban Institute, LGBTQ+ people are more likely to move to suburban areas, with 43% living in suburbs compared to 41% in urban areas. This suburban migration reflects the increasing visibility and acceptance of LGBTQ+ individuals in various communities beyond major cities.

Inclusive Schools: Welcoming LGBTQ+ Children

Creating inclusive educational environments that welcome LGBTQ+ children is vital for their well-being and academic success. According to GLSEN’s National School Climate Survey, progress has been made in recent years. In 2019, 54% of LGBTQ+ students reported having access to LGBTQ+-inclusive curriculum, a significant increase from previous years. However, challenges persist, as 81% of LGBTQ+ students experienced verbal harassment based on their sexual orientation, and 64% experienced harassment based on their gender expression. Schools and policymakers must continue working to implement comprehensive anti-bullying policies, inclusive curriculum, and support systems to ensure that LGBTQ+ students feel safe and supported in their educational environments.

While LGBTQ+ family formation has seen significant progress with the legalization of same-sex marriage, housing discrimination and challenges persist. By raising awareness to and understanding these statistics, we can continue advocating for equal rights, fostering inclusive communities, and working towards a more equitable society for all individuals, regardless of their sexual orientation or gender identity. Research indicates that nondiscrimination laws and ordinances increase consumer confidence which increases confidence in the housing market.

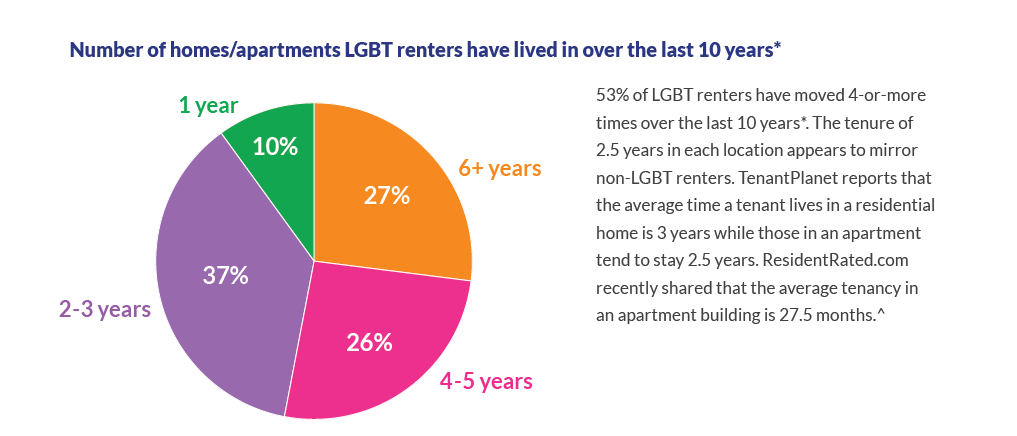

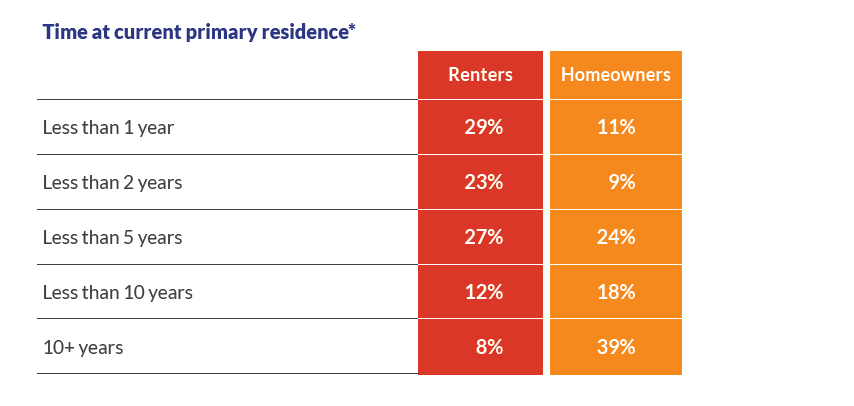

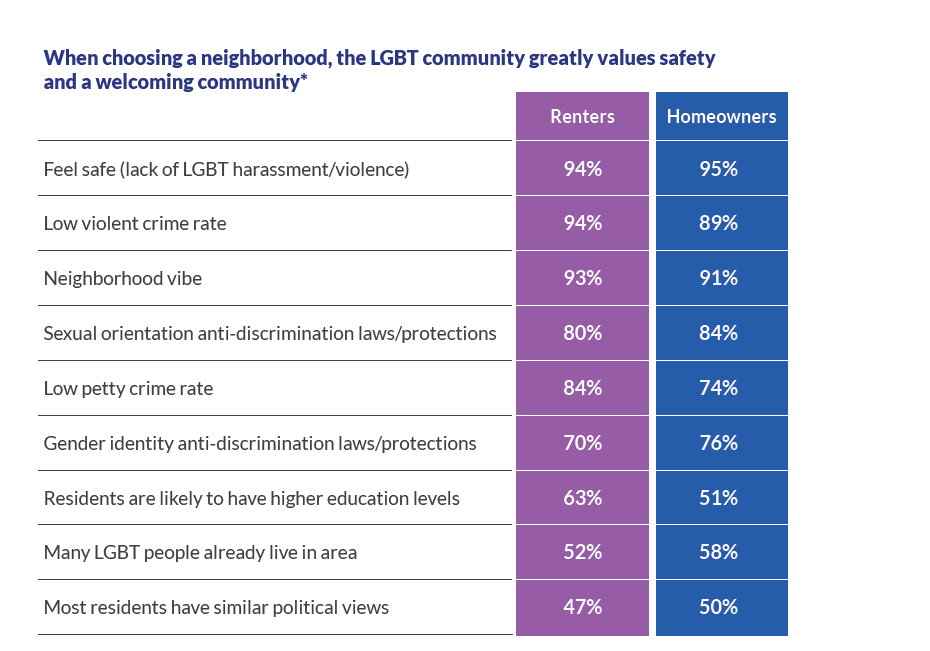

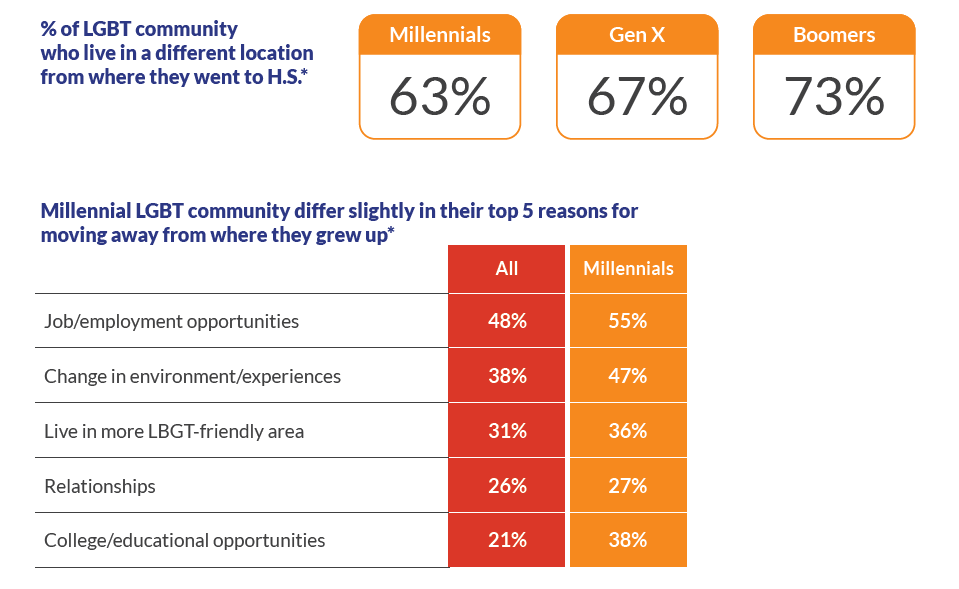

LGBT Community on the Move

The homeownership process begins with the decision of where to live. Freddie Mac found that only 32% of LGBT people live in the same general location (i.e. city, county, metro area) as where they went to high school. This figure is dramatically lower than the 72% who live in or close to the city they grow up according North American® Van Lines.

Homeownership allows the LGBT community to establish roots as 57% of LGBT homeowners have been in their primary residence for more than 5 years. Also, 74% of LGBT homeowners have lived in only one region of the country/world in the last 3 years compared to 51% of LGBT renters*.

Analyzing LGBTQ Homeownership Rates and the Desire to Buy

The pursuit of homeownership has long been considered a significant milestone in one’s life, symbolizing stability, investment, personal achievement, and often defines achieving the American Dream. However, when it comes to LGBTQ individuals and families, the journey towards owning a home has often been riddled with unique challenges. In this section of the report we will delve into the statistics surrounding LGBTQ homeownership rates compared to their non-LGBTQ counterparts. Additionally, we will explore the aspirations of LGBTQ renters and their desire to purchase a home.

LGBTQ Homeownership Rates

Disparities in Homeownership Rates:

According to the 2021 NAGLREP LGBT Real Estate Report powered by Freddie Mac, LGBTQ individuals have historically faced lower rates of homeownership 49% compared to their non-LGBTQ counterparts 65%. The reasons for this disparity can be attributed to several factors, including income disparities, discrimination in the housing market, and legal barriers.

Income Disparities:

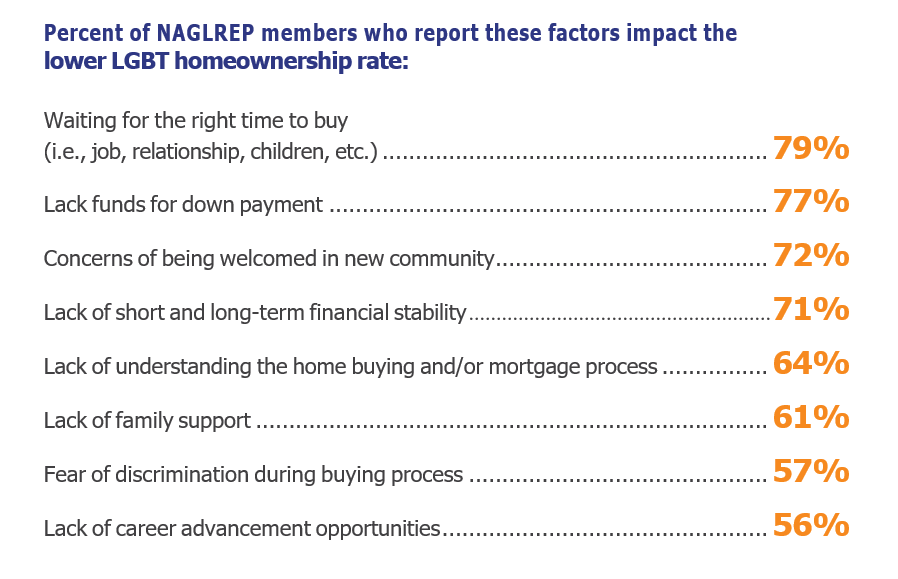

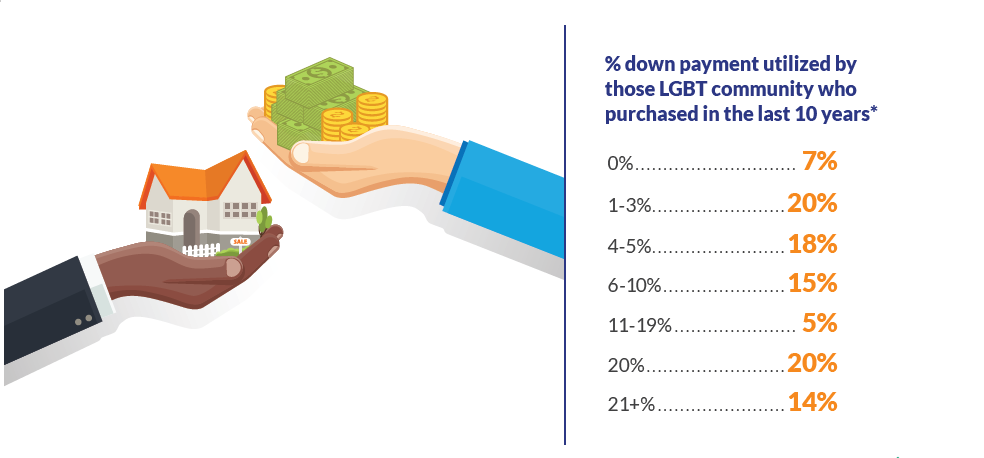

Statistical data reveals that LGBTQ individuals experience a higher poverty rate compared to non-LGBTQ individuals. This income disparity can limit their ability to save for a down payment or qualify for a mortgage, making homeownership a more challenging endeavor. Furthermore, statistics show the most often source of a down payment on a home is a gift or loan from family. Due to constraints often found in families due to a family member’s sexual orientation or gender identity, down payments from family are not as often available to LGBTQ persons compared to non LGBTQ persons.

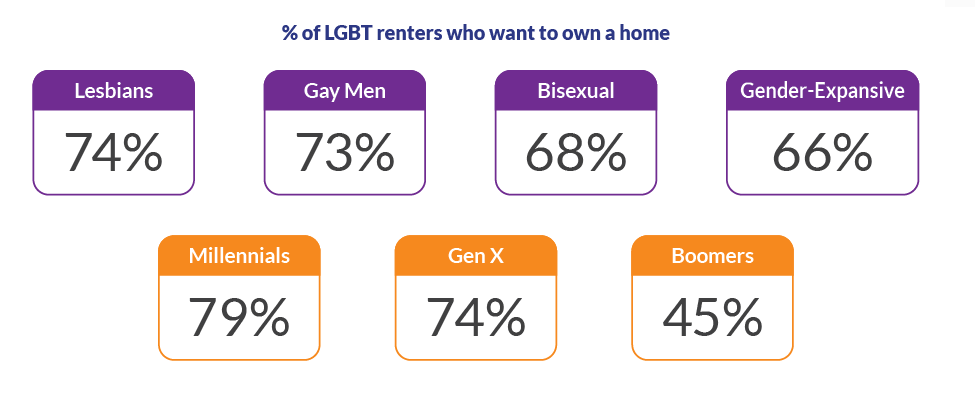

LGBTQ Renters and Desire to Buy

Aspirations for Homeownership:

Despite the barriers they face, LGBTQ renters often express a strong desire to become homeowners. Owning a home represents not only a sense of security but also a way to establish roots, build equity, and create a safe and inclusive space.

Financial Considerations

Research indicates that LGBTQ renters, like their non-LGBTQ counterparts, prioritize financial stability and the long- term benefits of homeownership. Many LGBTQ individuals view homeownership as a means to build wealth, particularly considering the potential for property value appreciation.

Unique Challenges

However, LGBTQ renters may face additional challenges when transitioning from renting to homeownership. These challenges can include the current high price of homes, higher mortgage rates, tighter credit, the need for LGBTQ-friendly neighborhoods, concerns about discriminatory practices from sellers or real estate agents, and sometimes a limited access to LGBTQ-friendly resources and support.

Advocacy and Education

However, LGBTQ renters may face additional challenges when transitioning from renting to homeownership. These challenges can include the current high price of homes, higher mortgage rates, tighter credit, the need for LGBTQ-friendly neighborhoods, concerns about discriminatory practices from sellers or real estate agents, and sometimes a limited access to LGBTQ-friendly resources and support.

Financial Barriers

Some programs and initiatives offer financial assistance, grants, and down payment assistance specifically targeting LGBTQ individuals. These resources aim to provide support to overcome the financial barriers faced by the LGBTQ community, helping them achieve their homeownership goals.

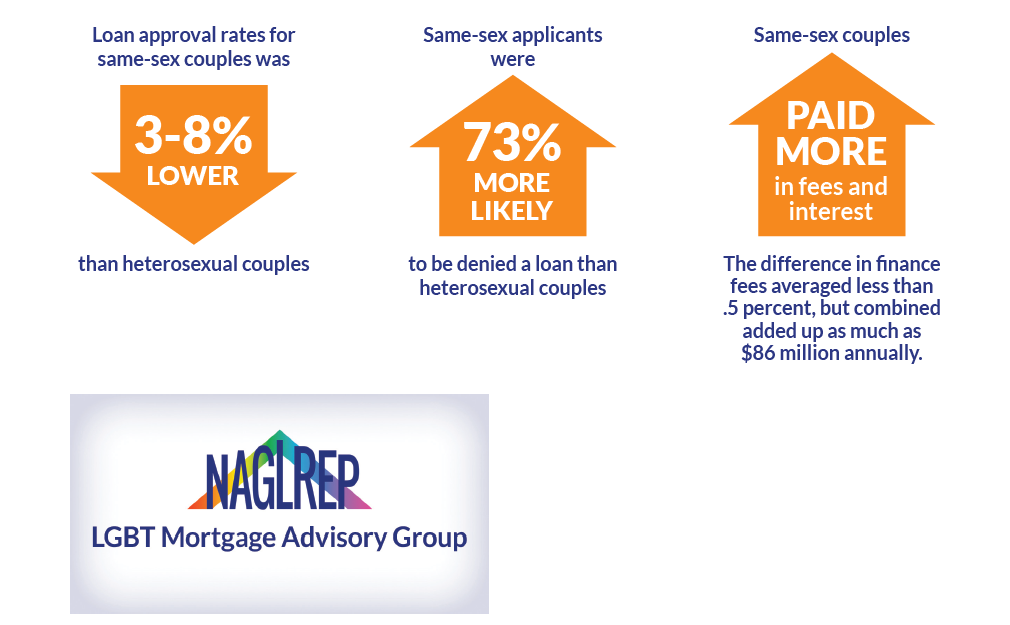

The Lending Process and Discrimination

Researchers in Iowa State University’s Ivy College of Business analyzed national mortgage data from 1990 to 2015 and found lower approval rates, higher finance fees and evidence of discrimination for same-sex borrowers. This occurred despite no evidence that same-sex couples had a higher default rate.@

The report also showed an unhealthy bias again neighborhoods with higher concentrations of same-sex couples. In these instances, all borrowers experienced more unfavorable lending outcomes.

NAGLREP launched the LGBT Mortgage Advisory Group to represent the interests of LGBT home buyers and mortgage professionals focusing on advocacy, education and empowerment. The LGBT Mortgage Advisory Group will work to create policy towards ending discrimination in any phase of the mortgage process. It will also identify opportunities to increase the LGBT homeownership rate and showcase the lending industry as a viable career for the LGBT community.

LGBT Community and Financing

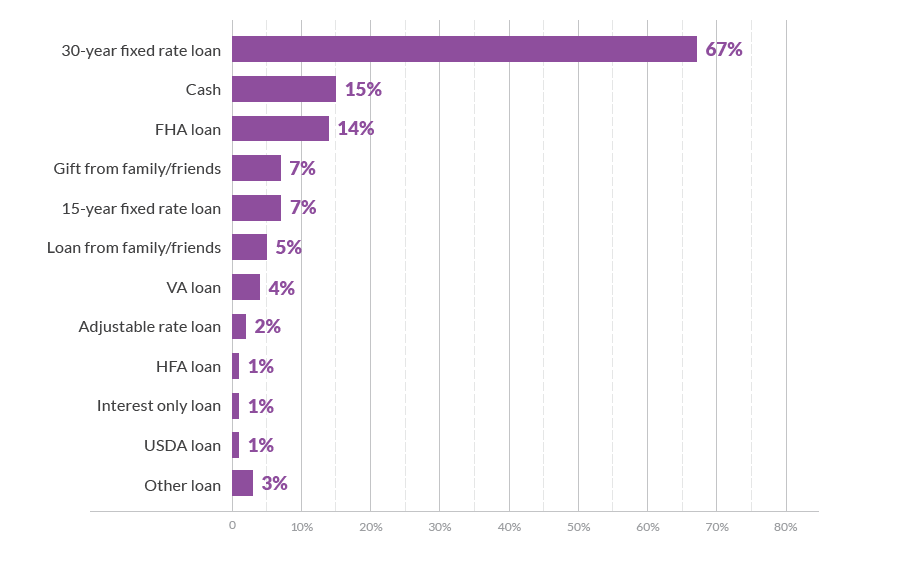

A 30-year fixed rate loan is the most common form of financing for those in the LGBT community who purchased in the last 10 years.*

A Generational Perspective

Next we will examine the homeownership statistics for various generations within the LGBTQ community, focusing on Generation Z, Millennials, Generation X, Baby Boomers, and even the emerging Generation Alpha.

Generation Z (Born: 1997-2012)Generation Z individuals are just beginning to enter the homeownership landscape. As a more socially progressive and inclusive generation, they are benefiting from increasing acceptance and legal protections for LGBTQ individuals. However, due to their young age, homeownership rates among Gen Z are relatively low. Many individuals within this generation are still pursuing higher education or starting their careers, which can delay their ability to save for a down payment. Nonetheless, Gen Z’s growing awareness and activism regarding LGBTQ rights bode well for future homeownership rates.

Millennials (Born: 1981-1996) Millennials have become a significant force in the housing market, with a strong presence within the LGBTQ community. This generation has faced unique challenges, including the aftermath of the 2008 financial crisis, student loan debt, and a changing job market. Despite these hurdles, millennials in the LGBTQ community have made strides in homeownership. A study by NAGLREP powered by Freddie Mac in 2021 reported that 49% of LGBTQ millennials were homeowners, surpassing the overall homeownership rate for millennials, which stood at 41%.

Generation X (Born: 1965-1980) Generation X, sandwiched between the larger Baby Boomer and millennial generations, has witnessed significant changes in societal attitudes towards LGBTQ individuals throughout their lifetime. As a result, many Gen X members have been able to achieve homeownership within a more inclusive environment. The exact homeownership statistics for the LGBTQ community within Generation X are not readily available. However, it is reasonable to expect that they have experienced a gradual increase in homeownership rates as acceptance and legal protections have expanded.

Baby Boomers (Born: 1946-1964) The Baby Boomer generation represents a transitional period in LGBTQ history. Many individuals within this generation grew up during a time when LGBTQ identities were often stigmatized and marginalized by the devastating effects of AIDS during the epidemic’s peak of 1987 – 1996. Consequently, Baby Boomers within the LGBTQ community may have faced significant obstacles in achieving homeownership. However, with changing societal norms and increased legal protections, the homeownership rates for LGBTQ Baby Boomers have likely improved over time.

Generation Alpha (Born: 2013-present) Although Generation Alpha, the youngest generation considered here, is still very young, it is worth noting that this generation is growing up in an increasingly inclusive and accepting world. With advancements in LGBTQ rights, representation, and education, it is expected that Generation Alpha LGBTQ individuals will face fewer barriers when it comes to homeownership in the future.

Looking Ahead with Optimism

While each generation faces unique challenges, including societal attitudes, economic factors, and legal protections, overall progress has been made. Millennials, in particular, have seen impressive gains in homeownership rates, surpassing the average for their generation. As younger generations, such as Generation Z and Generation Alpha, continue to enter the housing market, it is anticipated that LGBTQ homeownership rates will further improve.

However, despite the progress, it is essential to recognize that disparities and challenges persist within the LGBTQ community. Ongoing efforts are necessary to address systemic discrimination, income disparities, and lack of access to resources that can hinder LGBTQ individuals’ ability to achieve homeownership. Advocacy for inclusive housing policies, affordable housing initiatives, and financial education tailored to the LGBTQ community can help bridge these gaps.

Furthermore, it is important for lenders, real estate agents, and housing providers to undergo sensitivity training and adopt inclusive practices to ensure equal treatment and opportunities for LGBTQ individuals in the housing market. Efforts to promote safe and inclusive neighborhoods, where LGBTQ individuals can feel welcomed and supported, also contribute to creating a more confident homeownership landscape.

In Conclusion

The LGBTQ community has made significant progress in homeownership rates across generations. From Generation Z to Millennials, Generation X to Baby Boomers, and the emerging Generation Alpha, societal shifts and legal advancements have paved the way for increased LGBTQ homeownership. However, ongoing efforts are needed to address remaining disparities and ensure that all individuals within the LGBTQ community have equal access to the dream of homeownership. By continuing to advocate for inclusive policies and practices, we can foster a more inclusive and equitable housing market for generations to come.

LGBT Community: Just Like Everyone Else

Outside of discrimination, the LGBT community has similar concerns and challenges that any renter, buyer or seller might have.

Along its work with HRC and NGLCC, NAGLREP has partnered with PFLAG, the first and largest organization for the LGBT community, their parents, families and allies. NAGLREP and PFLAG entered into a Memorandum of Understanding (MOU) to galvanize local support for the Equality Act and other issues, along with exposing more LGBT people to the emotional and financial benefits of homeownership. The two groups created training for LGBT home buyers and sellers on a variety of topics including how to best identify and work with LGBT and ally agents and service providers, navigate the lending process and how to identify the most welcoming neighborhood.

Along its work with HRC and NGLCC, NAGLREP has partnered with PFLAG, the first and largest organization for the LGBT community, their parents, families and allies. NAGLREP and PFLAG entered into a Memorandum of Understanding (MOU) to galvanize local support for the Equality Act and other issues, along with exposing more LGBT people to the emotional and financial benefits of homeownership. The two groups created training for LGBT home buyers and sellers on a variety of topics including how to best identify and work with LGBT and ally agents and service providers, navigate the lending process and how to identify the most welcoming neighborhood.

National Association of REALTORS (NAR)

National Association of REALTORS (NAR)

In 2008, NAGLREP brought forward to NAR the proposal to amend article 10 of the Realtor® Code of Ethics to prohibit members from discriminating based on sexual orientation and gender identity. By 2011 sexual orientation was added, and by 2013 gender identity was added to the NAR Code of Ethics. This is the first time ever a protected class has been added to the NAR Code of Ethics prior to Federal Fair Housing Law first adding protections.

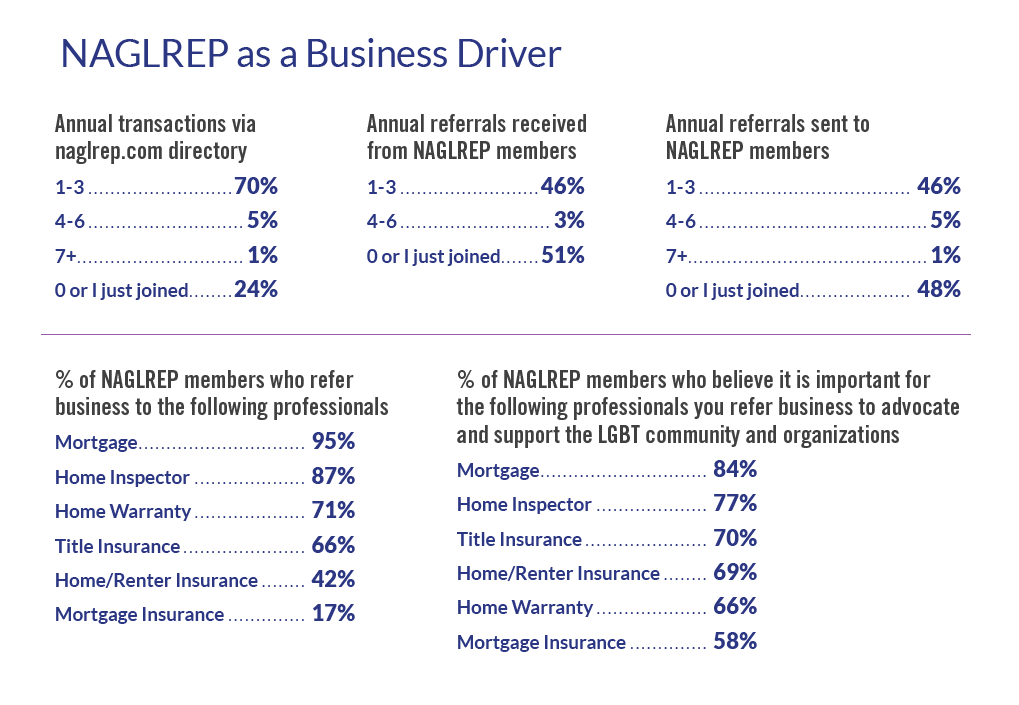

A Look at NAGLREP

NAGLREP has grown to nearly 2,800 members with 44 chapters as one of the nation’s largest LGBT trade organizations. Membership is up more than 100% in the last four years.

Why Do We Need NAGLREP?

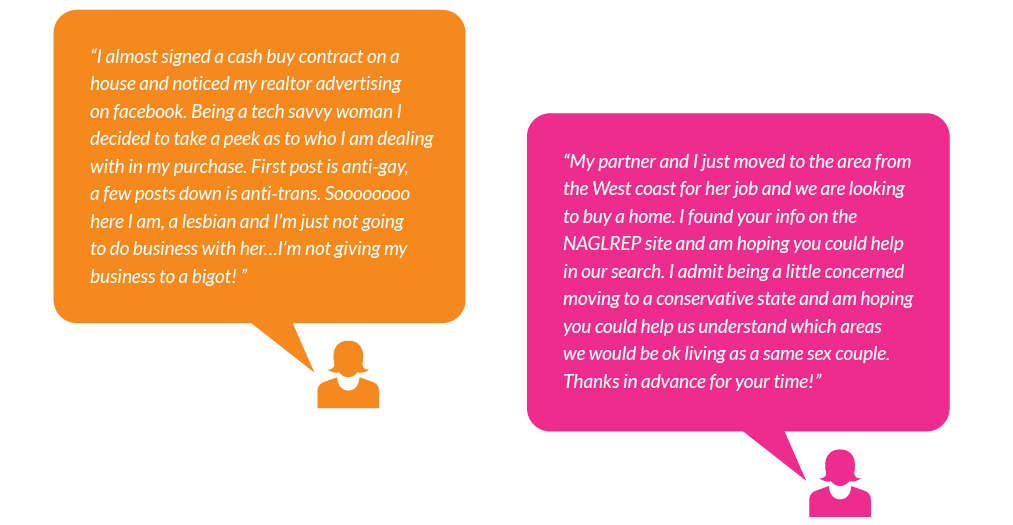

NAGLREP.com receives 75,000 unique visitors a month, largely consisting of those looking to connect with NAGLREP members for their real estate needs. Many visitors share comments included in their request to connect with a NAGLREP member that showcase the challenges and concerns members of the LGBT community face when buying, selling and moving.

Here are samples of recent consumer comments NAGLREP has received (excludes agent contact name, along with specific addresses of properties):